These legalistic terms have important consequences on who inherits from you and how much, whether under a will or a trust or even if intestate (no will or trust). There are many important decisions to make under a will or a trust, but one of them is who will inherit from you and there are legal standards that dictate that. I ask clients to say in their own words what they want to happen for their children and grandchildren and then the appropriate terminology is used in their will or trust. Below is a brief explanation and example of how those two terms divide an estate differently. Furthermore, each state is different on what it presumes should be the standard if you don’t have a will or trust or your document is unclear.

Per Stirpes

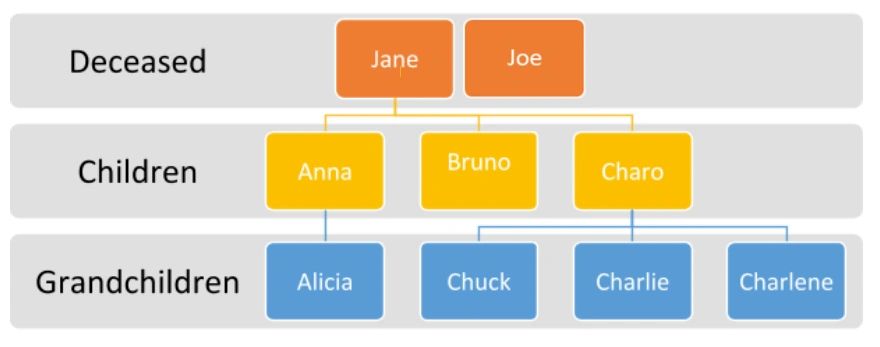

Per Stirpes is commonly used and what most states’ law presume, if a will or trust doesn’t say differently. This is a Latin term that translates to “of the branch”. California Probate Code §240 divides estate per stirpes. Examples and diagrams are easiest to understand. The example below is a married couple where all their children are to be treated equally after the surviving spouse’ death, per stirpes. Jane and Joe have three children and several grandchildren.

Scenarios applying per stirpes:

In the above diagram, under a traditional per stirpes approach, once both Jane and Joe are deceased, their estate will get split 3 ways between Anna, Bruno and Charo. Easy enough.

But if Bruno dies and he has no children, then his 1/3 goes back into the estate and the estate is split ½ to Anna and ½ to Charo. Again, pretty straightforward.

Now, assume Bruno is alive and Anna and Charo predecease their last surviving parent, then their branch of children will step up to take each of their 1/3 share and that 1/3 share will be split between the number of children each had. The distributions are as follows:

1/3 to Bruno

1/3 to Alicia (she gets all of Anna’s 1/3 share) and

Charo’s 1/3 is divided 3 ways resulting in: 1/9 to Chuck,

1/9 to Charlie, and 1/9 to Charlene

By Representation

On the other hand, the words by representation or by right of representation or per capita at each generation may create a different result depending on how the heirs survive and predecease the parents. All states have this concept, so if it is stated in your will or trust, this standard will be followed. Arizona is one of the states that goes further under ARS §14-2709. The presumption is no longer per stirpes in Arizona. Instead, the estate is divided by Representation into as many equal shares as there are surviving descendants at that level.

Scenarios of by representation with our family tree above:

Once both Jane and Joe are deceased, their estate will get split 3 ways between Anna, Bruno and Charo. Same as above

If Bruno dies and he has no children, then his 1/3 goes back into the estate again and the estate is split ½ to Anna and ½ to Charo. Same result.

Now, Bruno survives, but Anna and Charo predecease the last surviving parent. There is an heir at the children level, so Bruno will receive 1/3 of his parent’s estate, as he was one of three children. Leaving 2/3 of the estate for the grandchildren, which will now be handled differently than per stirpes. Now the total number of grandchildren (4) split that 2/3rds. In other words, Charo’s children are not penalized for being from a larger family than Anna’s. All the grandchildren are treated equally. Thus, the distribution would be as follows:

1/3 to Bruno

1/6 to Alicia

1/6 to Chuck

1/6 to Charlie

1/6 to Charlene

Conclusion

Changes in the above facts will change the outcomes, but hopefully the examples above demonstrate how you can choose to follow the traditional path and the estate follows the branches of your lineal descendants or you choose to treat each class of heirs equally. There is no right or wrong answer. They are choices that fit each family differently. But if a person dies without a will or trust, then the state of his/her domicile at death will determine whether your estate is split per stirpes or by representation. In Arizona, that is by representation. In California that is per stirpes.

Disclaimer – This article is for information purposes only. It is not intended to provide legal advice to anyone. If you require advice, you should reach out to our firm or another lawfirm to discuss your facts and circumstances to obtain legal advice.